Key Stages Money Laundering Process

The idea of money laundering is very important to be understood for those working in the financial sector. It's a process by which soiled money is transformed into clear cash. The sources of the cash in actual are legal and the cash is invested in a means that makes it appear to be clean money and hide the identification of the criminal a part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new clients or sustaining present prospects the duty of adopting ample measures lie on every one who is part of the group. The identification of such aspect to start with is straightforward to take care of as a substitute realizing and encountering such conditions later on in the transaction stage. The central bank in any nation supplies full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to deter such situations.

However it is important to remember that money laundering is a single process. The Money Laundering Process The first step is called placement.

Anti Money Laundering And Counter Terrorism Financing

Abnormally big sums of money.

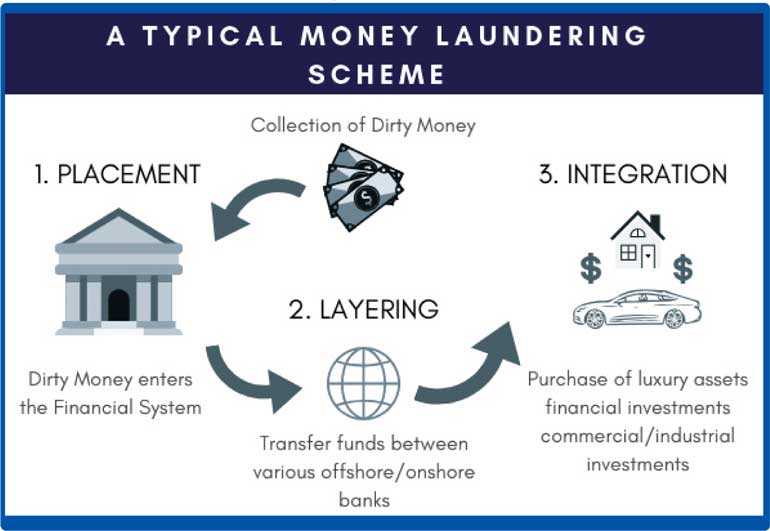

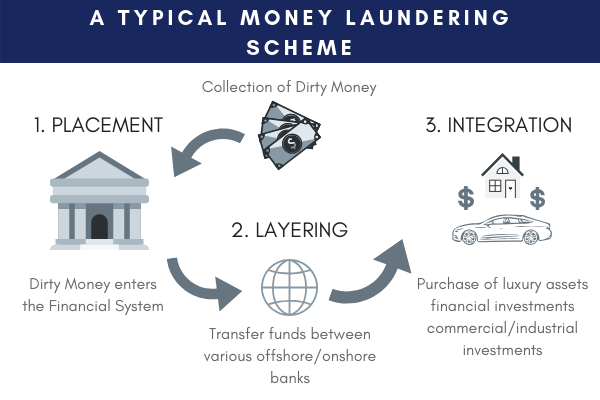

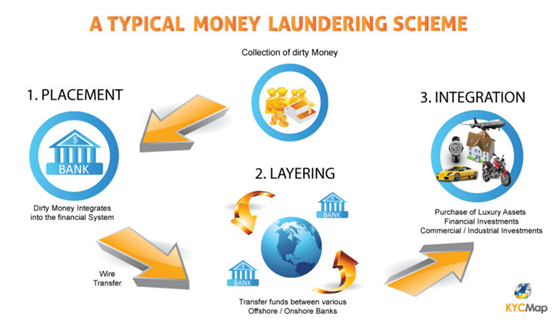

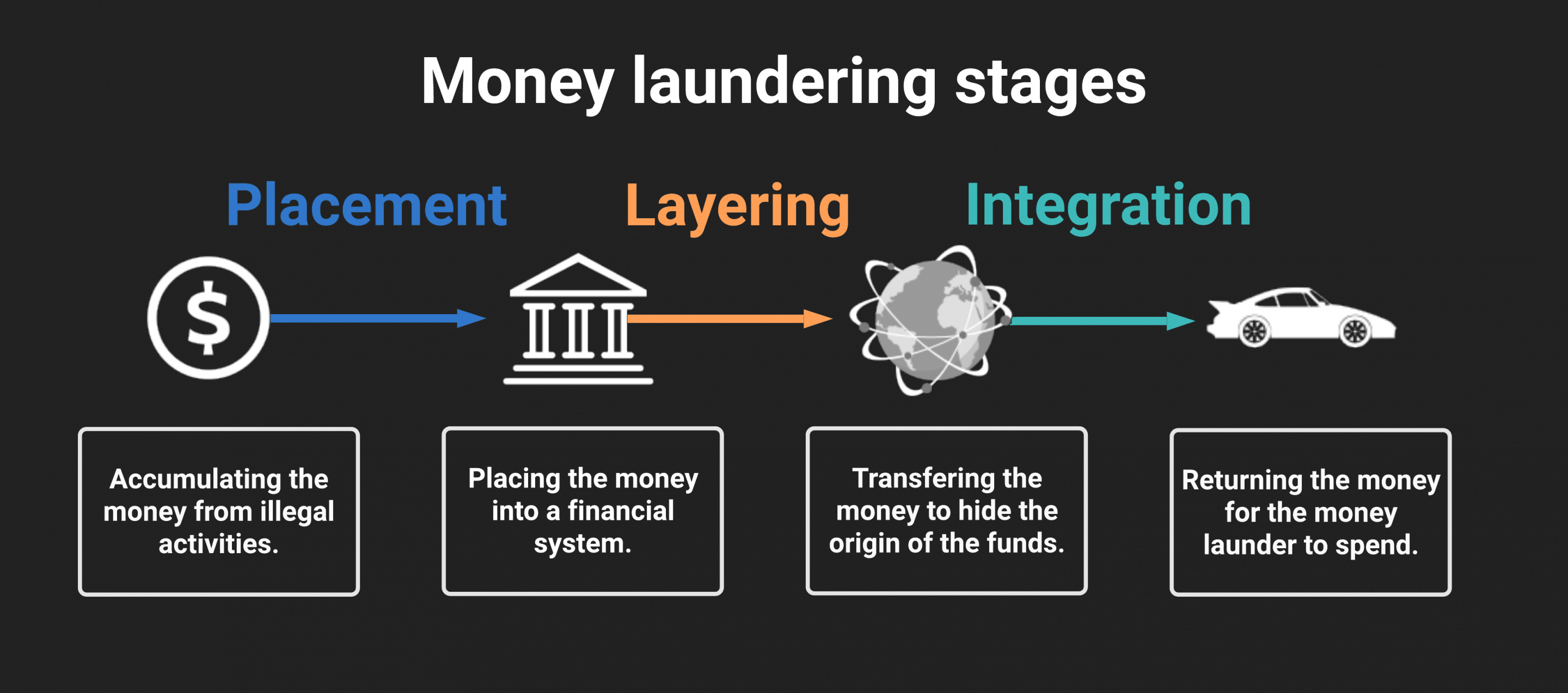

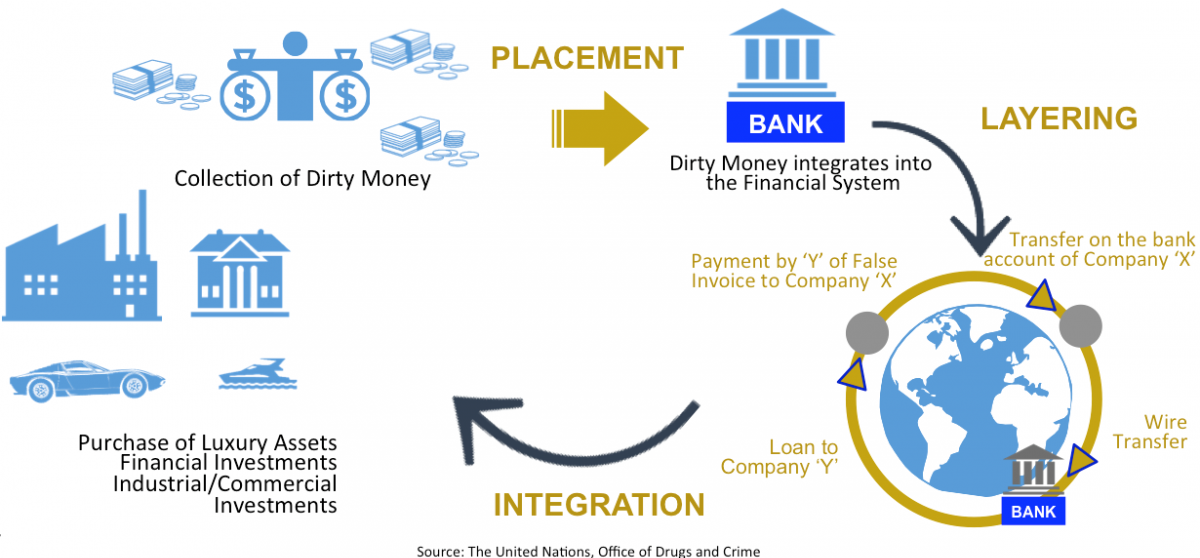

Key stages money laundering process. The criminal proceeds are deposited into the financial system usually through a financial institution by depositing cash into a bank account. There are three stages involved in money laundering. The money laundering process is composed by three phases.

The money laundering cycle can be broken down into three distinct stages. Placement accumulation and integration. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration.

The institution may be anything from a brokerage house or bank to a casino or insurance company. Cycle can be broken down into three distinct stages. However it is important to remember that money laundering is a single process.

Three stage process by dhananjay choudhary koda assoicates 2. The money-laundering cycle can be broken down into three distinct stages. However it is important to remember that money-laundering is a single process.

The initial stage of the money laundering process involves moving money from its source and putting it into circulation. The stages of money laundering include the. Moving the funds from direct association with.

Placement layering and integration. Often but not in every case in. There Money Laundering Risk Risk Management Data Mining Techniques I.

The money laundering process most commonly occurs in three key stages. How Money Laundering Works. Each individual money laundering stage can be extremely complex due to the criminal activity involved.

Initial entry or placement is the initial movement of an amount of money earned from criminal activity into some legitimate financial network or institution. The stages of money laundering include the. The stages of money-laundering include.

We have made up a guide containing the key components and a summary of all the steps needed to develop an effective compliance program. Placement layering and integration. Money laundering typically occurs in three phases.

The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. The first goal is to quickly expose money laundering associated activities like. And Clients which will have two stages first it is necessary to build a Regressive Model of Risk.

Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. Four methods of money launderingcash smuggling casinos and other gambling venues insurance policies and securitiesare described below in. This is the act of moving the ill-gotten funds into a financial institution.

At the placement stage for example the funds are usually processed relatively close to the under-lying activity.

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

Anti Money Laundering Overview Process And History

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

What Is Money Laundering Three Methods Or Stages In Money Laundering

What Is Money Laundering Tookitaki Tookitaki

What Are The Three Stages Of Money Laundering

Anti Money Laundering Bribery Awareness Ppt Download

Prevention Of Money Laundering Gov Si

What Is Money Laundering Three Methods Or Stages In Money Laundering

First Stage Of Money Laundering Placement People Launder Money Using Money Laundering Techniques For Two Principal Reasons

The 3 Stages Of The Money Laundering Process Explained Sentrient Youtube

The world of regulations can look like a bowl of alphabet soup at times. US cash laundering regulations are no exception. We've compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting firm centered on protecting monetary services by reducing threat, fraud and losses. We've got large bank experience in operational and regulatory danger. We've a robust background in program management, regulatory and operational risk as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many antagonistic consequences to the group as a result of risks it presents. It will increase the probability of major dangers and the chance cost of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment